Imagen 1 de 14

Galería

Imagen 1 de 14

¿Quieres vender uno?

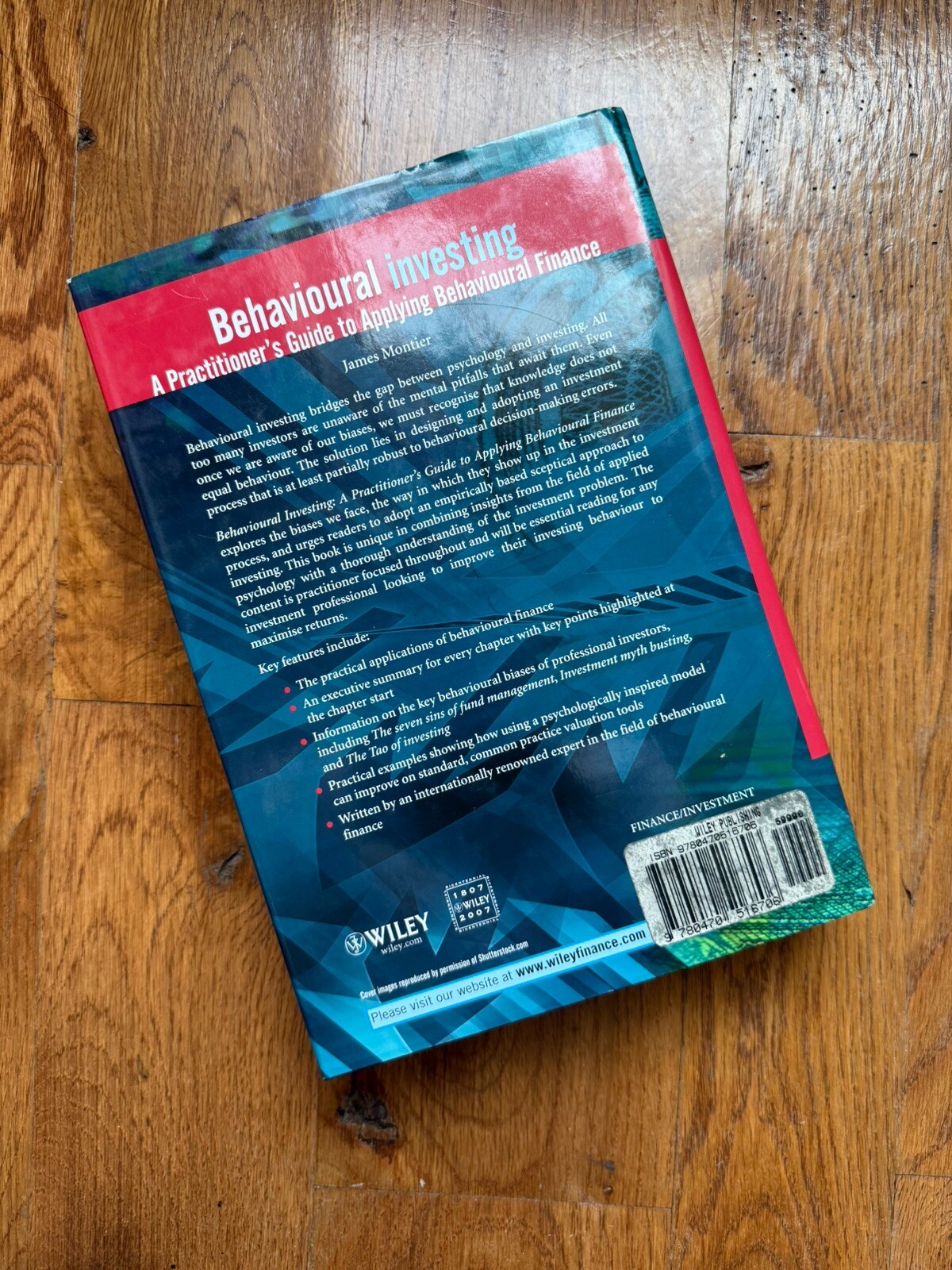

Behavioural Investing: A Practitioner's Guide to Applying Behavioural Finance

USD23,99

Aproximadamente20,58 EUR

Estado:

En muy buen estado

Libro que se ha leído y que no tiene un aspecto nuevo, pero que está en un estado excelente. No hay desperfectos visibles en la tapa y se incluye sobrecubierta, si procede, para las tapas duras. Todas las páginas están en perfecto estado, sin arrugas ni roturas y no falta ninguna. El texto no está subrayado ni resaltado de forma alguna, y no hay anotaciones en los márgenes. Puede presentar marcas de identificación mínimas en la contraportada o las guardas. Muy poco usado. Consulta el anuncio del vendedor para obtener más información y la descripción de cualquier posible imperfección.

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Envío:

USD9,72 (aprox. 8,34 EUR) USPS Media MailTM.

Ubicado en: Patterson, New York, Estados Unidos

Entrega:

Entrega prevista entre el mar. 14 oct. y el lun. 20 oct. a 94104

Devoluciones:

14 días para devoluciones. El comprador paga el envío de la devolución..

Pagos:

Compra con confianza

El vendedor asume toda la responsabilidad de este anuncio.

N.º de artículo de eBay:397112143100

Características del artículo

- Estado

- ISBN

- 9780470516706

Acerca de este producto

Product Identifiers

Publisher

Wiley & Sons, Incorporated, John

ISBN-10

0470516704

ISBN-13

9780470516706

eBay Product ID (ePID)

61172125

Product Key Features

Number of Pages

736 Pages

Publication Name

Behavioural Investing : a Practitioner's Guide to Applying Behavioural Finance

Language

English

Subject

Investments & Securities / Portfolio Management, Finance / General, Investments & Securities / General

Publication Year

2007

Type

Textbook

Subject Area

Business & Economics

Series

The Wiley Finance Ser.

Format

Hardcover

Dimensions

Item Height

1.9 in

Item Weight

53.7 Oz

Item Length

9.9 in

Item Width

7 in

Additional Product Features

Edition Number

2

Intended Audience

Scholarly & Professional

LCCN

2007-033391

Reviews

"It is quite simply the best and most comprehensive treatment of the subject to date." ( Financial Times , Monday 3rd December 2007) "The Year's most exhaustive, and often entertaining, coverage of the behavioural literature." ( Financial Times , Saturday 15th December 2007) "...one of the few 'must read' books on the topic of investing." ( The Herald - Glasgow , Saturday 2nd February 2008) "...a fantastic insight into how markets operate... [and] one of the few "must read" on the topic of investing." ( The Herald , Sat 2nd February 2008), "It is quite simply the best and most comprehensive treatment ofthe subject to date." ( Financial Times , Monday 3rdDecember 2007) "The Year's most exhaustive, and often entertaining, coverage ofthe behavioural literature." ( Financial Times ,Saturday 15th December 2007) "...one of the few 'must read' books on the topic ofinvesting." ( The Herald - Glasgow , Saturday 2ndFebruary 2008) " a fantastic insight into how markets operate [and] one of the few "must read" on the topic of investing."( The Herald , Sat 2nd February 2008)

Dewey Edition

22

Illustrated

Yes

Dewey Decimal

332.6

Synopsis

Behavioural investing seeks to bridge the gap between psychology and investing. All too many investors are unaware of the mental pitfalls that await them. Even once we are aware of our biases, we must recognise that knowledge does not equal behaviour., Behavioural investing seeks to bridge the gap between psychology and investing. All too many investors are unaware of the mental pitfalls that await them. Even once we are aware of our biases, we must recognise that knowledge does not equal behaviour. The solution lies is designing and adopting an investment process that is at least partially robust to behavioural decision-making errors. Behavioural Investing: A Practitioner's Guide to Applying Behavioural Finance explores the biases we face, the way in which they show up in the investment process, and urges readers to adopt an empirically based sceptical approach to investing. This book is unique in combining insights from the field of applied psychology with a through understanding of the investment problem. The content is practitioner focused throughout and will be essential reading for any investment professional looking to improve their investing behaviour to maximise returns. Key features include: The only book to cover the applications of behavioural finance An executive summary for every chapter with key points highlighted at the chapter start Information on the key behavioural biases of professional investors, including The seven sins of fund management, Investment myth busting, and The Tao of investing Practical examples showing how using a psychologically inspired model can improve on standard, common practice valuation tools Written by an internationally renowned expert in the field of behavioural finance, Behavioural investing seeks to bridge the gap between psychology and investing. All too many investors are unaware of the mental pitfalls that await them. Even once we are aware of our biases, we must recognise that knowledge does not equal behaviour. The solution lies is designing and adopting an investment process that is at least partially robust to behavioural decision-making errors. Behavioural Investing: A Practitioner s Guide to Applying Behavioural Finance explores the biases we face, the way in which they show up in the investment process, and urges readers to adopt an empirically based sceptical approach to investing. This book is unique in combining insights from the field of applied psychology with a through understanding of the investment problem. The content is practitioner focused throughout and will be essential reading for any investment professional looking to improve their investing behaviour to maximise returns. Key features include: The only book to cover the applications of behavioural finance. An executive summary for every chapter with key points highlighted at the chapter start. Information on the key behavioural biases of professional investors, including The seven sins of fund management, Investment myth busting, and The Tao of investing. Practical examples showing how using a psychologically inspired model can improve on standard, common practice valuation tools. Written by an internationally renowned expert in the field of behavioural finance.

LC Classification Number

HG4515.15.M657 2007

Descripción del artículo del vendedor

Información de vendedor profesional

Acerca de este vendedor

Three Brothers online sales Inc

99,6% de votos positivos•1,3 mil artículos vendidos

Registrado como vendedor profesional

Votos de vendedor (426)

- t***l (1711)- Votos emitidos por el comprador.Últimos 6 mesesCompra verificadaThank you! Great seller. Fair prices, fast and secure shipping/packaging, and just as described.

- 7***r (452)- Votos emitidos por el comprador.Últimos 6 mesesCompra verificadaMy shipment for a dvd arrived today right on schedule,packing was well packed for shipping,dvd was as described and was bought at a great price and a thank you for great customer serviceAlice Cooper And Friends DVD *Rare* 1977 Anaheim Ca. (#396677500995)

- b***b (19)- Votos emitidos por el comprador.Últimos 6 mesesCompra verificadaAn excellent seller! Answered all my questions quickly and kindly, even though it must have been a bit of a hassle. Always friendly, and the item arrived in great condition. Thank you!Kodak Digital Camera EasyShare C813 8.2MP Silver W/ Case ~ Clean ~ (Tested) (#396726280778)