Imagen 1 de 4

Galería

Imagen 1 de 4

¿Quieres vender uno?

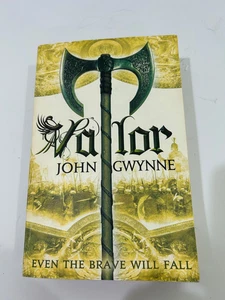

Valor: 2 (Faithful and the Fallen), Gwynne, John

USD13,88

Aproximadamente12,03 EUR

o Mejor oferta

Estado:

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Envío:

Gratis USPS Ground Advantage®.

Ubicado en: Medford, Oregon, Estados Unidos

Entrega:

Entrega prevista entre el mié. 5 nov. y el sáb. 8 nov. a 94104

Devoluciones:

30 días para devoluciones. El comprador paga el envío de la devolución..

Pagos:

Compra con confianza

El vendedor asume toda la responsabilidad de este anuncio.

N.º de artículo de eBay:297679187640

Características del artículo

- Estado

- Artist

- Gwynne, John

- Brand

- N/A

- EAN

- 9780275941253

- ISBN

- 0316399744

- Book Title

- Valor: 2 (Faithful and the Fallen)

- Release Title

- Valor: 2 (Faithful and the Fallen)

- Colour

- N/A

Acerca de este producto

Product Identifiers

Publisher

Bloomsbury Publishing USA

ISBN-10

0275941256

ISBN-13

9780275941253

eBay Product ID (ePID)

83528

Product Key Features

Number of Pages

360 Pages

Language

English

Publication Name

State Taxation of Business : Issues and Policy Options

Publication Year

1992

Subject

Taxation / Corporate, General

Type

Textbook

Subject Area

Education, Business & Economics

Format

Hardcover

Dimensions

Item Height

0.8 in

Item Weight

24.1 Oz

Item Length

9.2 in

Item Width

6.1 in

Additional Product Features

Intended Audience

College Audience

LCCN

92-015767

Reviews

"State Taxation of Business comprehensively presents the issues emerging from the great laboratory of the many Independent jurisdictions which characterize state and local taxation in the United States. As such, the book is worthy of attention by all those engaged in researching, formulating, or implementing tax policy." The Accounting Review

Number of Volumes

1 vol.

Illustrated

Yes

Table Of Content

Foreword by Frederick D. Stocker Introduction State Business Taxation: Description and Rationales What Taxes Do States Impose on Business? by Steven Galginaitis How Should Businesses be Taxed? by William H. Oakland Local Business Taxation and the Tiebout Model by Robert H. Aten State Taxation of Corporate Income Perspectives on the Reform of UDITPA by George N. Carlson, Gerald M. Godshaw, and Jeffrey L. Hyde Market Versus Production States: An Economic Analysis of Apportionment Principles by James Francis and Brian H. McGavin Federal Collection of State Corporate Income Taxes by Robert P. Strauss The Impact of State Corporate Income Taxes on the Economic Condition of the United States by Robert N. Mattson Exporting of State Taxes Techniques of Tax Exporting by William R. Brown The Role of Corporations in Tax Exporting by Burns Stanley Economic Analysis and Expert Testimony in Commerce Clause Challenges by Ferdinand P. Schoettle State Taxation of Telecommunications Critical Issues in State Taxation of Telecommunications by Walter Hellerstein Apportionment of Telecommunications Interstate Attributes for Income, Consumption, and Property Tax Purposes by Patrick J. Nugent State Taxation of Multistate Banking Economic Effects of One State Enacting Destination Source Taxation of Financial Institutions by Thomas S. Neubig Neutral Taxation of Financial Institutions During the 1990s by William F. Fox and Michael P. Kelsay State Taxation of Insurance Companies Overview of State Insurance Taxation by John W. Weber, Jr. Economic Issues in State Taxation of Insurance Companies by Thomas S. Neubig and Michael Vlaisavljevich Neutrality in State Insurance Taxation by Martin F. Grace and Harold D. Skipper, Jr. Insurance Taxation: Policyholder Dividends and Insolvencies by James Barrese Environmental Taxes and Fees State Environmental Taxes and Fees by Joseph J. Cordes State and Local Government Initiatives to Tax Solid and Hazardous Waste by Robert A. Bohm and Michael P. Kelsay Epilogue: Goals and Strategies for Business Tax Reform Selected Bibliography Index About the Contributors

Synopsis

This volume is the first book-length treatment of state-level business tax issues. It addresses three broad questions: (1) How should businesses be taxed? (2) How does present practice compare with and depart from this prescription? and (3) How can present practice be improved? The contributors to the volume analyze these issues from a variety of perspectives, presenting a cross section of current thinking about states' business tax policies. The work provides a conceptual framework for defining business taxes, measuring their levels and consequences, comparing interstate differences in business tax practices, and evaluating alternative business tax policies. It presents data showing current levels, trends, and interstate differences in business taxation. And it examines the political and economic rationales for taxing business and the implications of those rationales for tax policy. This analysis will be of interest to scholars and practitioners in taxation, public economics, and business finance.

LC Classification Number

HD2753

Descripción del artículo del vendedor

Acerca de este vendedor

Bevins Resales

99,4% de votos positivos•6,3 mil artículos vendidos

Registrado como vendedor particularPor tanto, no se aplican los derechos de los consumidores derivados de las leyes de protección de los consumidores de la UE. La Garantía al cliente de eBay sigue aplicando a la mayoría de compras. Más informaciónMás información

Votos de vendedor (2.604)

- -***g (42)- Votos emitidos por el comprador.Últimos 6 mesesCompra verificadaBevins Resales is the best!! I received a different top than what I ordered. Seller was very quick to respond saying they would send out the correct one right away. I was told to keep the top I received in error AND was refunded the money for the original order! Wonderful customer service - I would definitely purchase from them again - thank you very much, you are very kind!Catherines Womens Tunic Top Size 5X 34/36W Blue Sequined Tunic (#297207062471)

- _***a (58)- Votos emitidos por el comprador.Últimos 6 mesesCompra verificadaThis is a beautiful dress as described and a good value. It did not fit me however and seller was very courteous about return however I realized this beautiful dress would likely fit a friend who happened to have a birthday 2 days ago and it does and she loves it so I ended up keeping it. I would absolutely buy from this seller again and be happy to. It was packaged well and arrived earlier than expected.Holding Horses Anthropologie Medium Dress Purple Periwinkle Embroidered Linen (#296593253640)

- l***i (253)- Votos emitidos por el comprador.Últimos 6 mesesCompra verificadaExactly as described & much nicer than pictured or expected. Well priced. Arrived quickly & extremely carefully packed for shipping. Excellent customer service with very pleasant communications. A great pleasure doing business with this seller. Thanks. A+++Porcelain Trinket Tray Delvaux Paris. 5" x 3". Hand painted Floral gold trim (#297425613091)

Más que explorar:

- Libros infantiles y juveniles John Steinbeck,

- Libros antiguos y de colección John Galsworthy,

- Libros infantiles y juveniles John Green,

- Libros de literatura y narrativa John Grisham,

- Libros infantiles y juveniles John Grisham,

- Libros de literatura y narrativa The Walking Dead en inglés,

- Libros de literatura y narrativa The Walking Dead